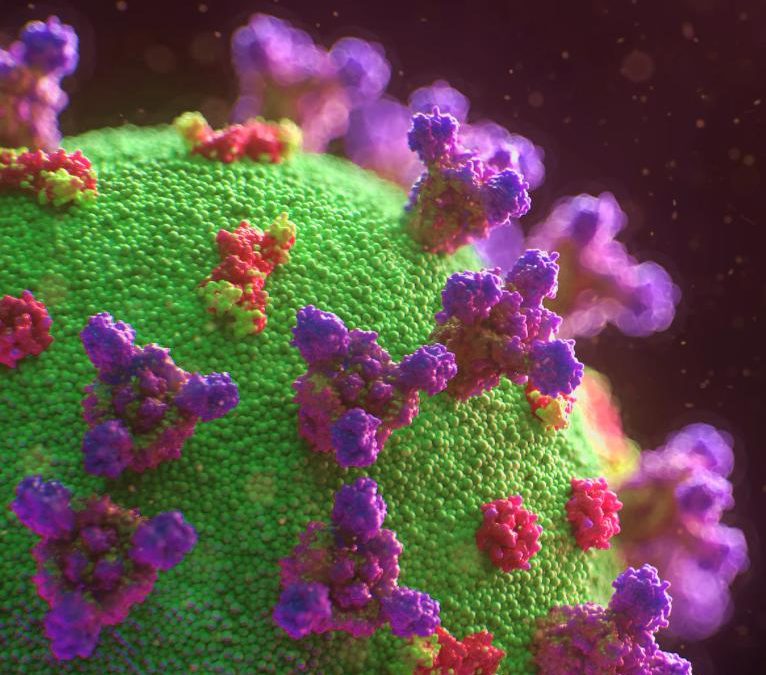

The Corona Virus Outbreak

Amid the current coronavirus outbreak, we’re all battling to keep up with the raft of new phrases entering everyday language – ‘social distancing’, ‘self-isolation’, ‘furloughing’.

With the UK in lockdown and the pandemic set to impact on all our lives for months to come, you might be living with the threat of redundancy or have been furloughed, forced to stay at home and possibly on only 80% pay.

You’ve probably settled into a ‘new normal’ and found your priorities changed – your main day-to-day concerns being food, shelter, and maintaining your physical and mental health.

If money is a worry too, you’ll be looking to free up funds. You might begin to look upon your pension contributions as an unnecessary, or even frivolous expense.

Before you cash in your pension, reduce, or entirely stop your contributions, here are three things to consider.

1. Don’t Panic!

In stock market terms, the current period of short-term volatility caused by coronavirus is a blip, like that caused by the Brexit negotiations, the US-China trade wars, or previous pandemics.

Short, sharp shocks are to be expected but we know that in the long term, markets tend to offer positive returns. Over the last 25 years, the FTSE 100 has experienced many downturns and yet IG confirms a compound annual return over that time of 6.4% with dividends reinvested: a total return of 375%.

The message, therefore, is don’t panic. Stay invested and, if you can afford to, keep paying into your pensions.

2. Avoid coronavirus scammers

Scammers will take advantage of any situation and that includes the current Covid-19 pandemic.

Action Fraud report that they have received 105 reports since 1 February 2020, with total losses reaching nearly £970,000.

The scams have included the selling of non-existent items, from face masks and coronavirus cures or medicine, to cheap flights. Other scams to look out for include:

Scammers sending out investment scheme and trading advice encouraging people to take advantage of the current economic downturn

Emails purporting to be from HMRC offering tax refunds

Fake advice on combatting the virus claiming to come from the World Health Organisation (WHO)

Lists of locally infected people available for bitcoin payments

Generally, anti-scamming advice around pensions and investments remains the same:

Ignore unsolicited offers, either by email or ‘cold calling’, especially anyone claiming to be able to generate higher returns on your pension savings. Keywords that should set alarm bells ringing include:

- ‘guarantee’

- ‘free pension review’

- ‘savings advance’

- ‘loophole’

Be wary of time-limited offers, especially if they involve high-risk or unusual investments, including those located overseas where regulation will be different, or not exist at all. Don’t allow anyone to pressure you into making a decision and always take time to consider any offer you receive. Speak to us if you’re unsure.

Check the Financial Services Register to make sure that the person or company you are speaking with is Financial Conduct Authority (FCA) registered and that they are authorised to provide the services they are seeking to undertake for you.

3. Mitigate the impact of reducing or ceasing pension contributions

It might not be financially viable for you to maintain your current pension contributions. Reduced working hours, or redundancy, might mean you need to reduce your payments, or temporarily stop contributing altogether.

If this becomes necessary, bear the following in mind.

State Pension

The current weekly State Pension is £175.20; £9,110.40 annually. It’s unlikely to be enough to cover your retirement plans but it is a stable and reliable source of income that you can build into your budgeting.

To qualify for the full State Pension, you must have 35 years of National Insurance Contributions (NICs) on your record. If you stay at work during the current crisis your NICs will continue to be paid but if you are made redundant your NICs will stop.

Check your National Insurance record – you may already have more than 35 qualifying years, in which case you needn’t worry – and also remember that you can make voluntary contributions to cover gaps in your record from the past six years.

A guaranteed pension stream in retirement is crucial and the State Pension can provide that. Be aware of your contribution record and plan to retire with as near to the full State Pension as you can.

Defined Contribution (DC) pensions

Unless you have opted out of auto-enrolment, you will likely have at least one DC pension. If you’re currently struggling with a reduced income it might be tempting to opt-out of your company pension scheme, but you should think very carefully before making that decision.

The minimum contribution under auto-enrolment is 8%, of which 3% must be paid by your employer.

This means that for every 5% you pay in, an additional 3% is being added by your employer and this is still the case during the current crisis – the government has committed to emergency help to ensure employer contributions continue to be made, even for furloughed staff.

If you are made redundant it might be possible to continue paying into your DC pension, but you will need to check whether your scheme allows it.

You might also think about paying any redundancy money you receive into your pension, thereby receiving tax relief on it. This can be done up to the Annual Allowance of £40,000 a year, or 100% of your earnings (whichever is lower).

Final salary

A Final Salary (or Defined Benefit) scheme pays a pre-defined amount when you retire. The pension you receive is based on:

- The number of years you paid into the scheme

- Your salary – either a career average or your final salary

- The accrual rate – a set percentage of your salary multiplied by the number of years you’ve been a member of the scheme

The pension you receive from a Defined Benefit (DB) scheme is often more generous than you’d receive with a DC scheme, and it will likely have additional benefits too – your income is usually linked to inflation and may include a spouse’s pension payable on your death.

If you want to know how much income you will receive from your DB scheme, speak to your provider.

Pension benefits can be taken from age 55. If you are over this age and struggling financially in the current crisis, it might be tempting to transfer out of your DB pension, allowing you to access funds through Pension Freedoms.

Transferring out of a DB scheme is rarely a good idea because the schemes favourable benefits will likely be lost. Think carefully before making that decision and speak to us.

Also, be wary of ceasing contributions. It’s unlikely you’ll be able to reduce your contributions into a DB scheme and the only way to stop them entirely is by opting out – talk to us and also your scheme provider to check whether you would be allowed to re-join the scheme in the future.

Get in touch? We can help.

If you have questions about the impact of coronavirus on your retirement planning, please get in touch.

You can call 01158 967 538 or click on the button below

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. Workplace pensions are regulated by The Pension Regulator.