Helping you save and plan for retirement is one of the most important things a financial adviser can do for you.

Living comfortably in the present, while having confidence that you can afford your desired lifestyle in retirement is a tricky balancing act, but a good retirement plan can ensure your aspirations are realistic and achievable.

Whether you opt for an Annuity or Flexi-Access Drawdown, at Credencis, we have pension drawdown calculators that can help you.

And the importance of advice doesn’t stop once you retire. Managing your pension income – especially if you opt for Flexi-Access Drawdown – can be tricky. We can help there too, so get in touch.

Things to consider before taking your pension as an Annuity

Take a look at our pension calculator, but before you do, here are some things to consider.

What is an Annuity?

Before the introduction of Pension Freedoms in 2015, an Annuity was the go-to option when taking your pension income.

You can take up to 25% tax-free cash and use the remainder of your fund to buy a regular income. You choose the frequency of payment, as well as any ‘extras’ such as a spouse’s pension or an increasing payment to counter the effects of inflation.

What are the pros and cons of an Annuity?

Once you have settled on your Annuity, it’s unlikely you will be able to change it. It is inflexible and can’t consider future changes in your circumstances or needs.

But it is a regular and stable income, and this makes budgeting in retirement easier. An Annuity pays for life, so you’ll have no concerns about running out of money.

How can our pension calculator help?

Use our pension calculator to input how many years you are away from retirement and the amount you think you can afford to contribute. Our calculator will let you know how much you could expect to receive at retirement.

If you already have pension pots, you can also add their values.

You can also state how much you’d like to receive at retirement. Our calculator will let you know if you currently have a pension shortfall and how much you would need to contribute to make up that shortfall.

Speak to us and we can take a holistic view of your finances and help put a realistic plan in place to get you where you want to be.

Things to consider before taking your pension using Flexi-Access Drawdown

You might find our Flexi-Access Drawdown calculator helps you decide if it’s the right option for you. But be sure to speak to us before you make a final decision.

What is Flexi-Access Drawdown?

Drawdown has been around for some time, but Flexi-Access Drawdown arrived as part of Pension Freedoms.

As with an Annuity, you can take tax-free cash up to a maximum of 25%, but, unlike an Annuity, the rest of your fund remains invested.

You can then make withdrawals as and when you like, giving you the freedom to decide how much you need at one time, and how much is left.

What about the pros and cons of Flexi-Access Drawdown?

Flexi-Access Drawdown gives you enormous control over how and when you take your pension. If your fixed costs are covered elsewhere, you might use drawdown to cover discretionary expenses, like holidays.

You are squarely in control of your pension income, but the emphasis is on you to budget responsibly.

Ensuring you don’t run out of money, especially during periods of market volatility, can be tricky. Try our calculator and then speak to us.

How can our pension calculator help?

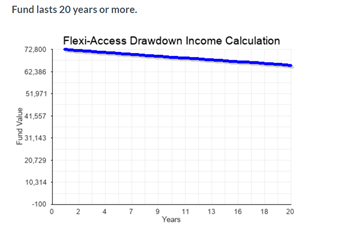

Input the number of years you are away from retirement; plus the amount you’d like to designate to drawdown. You can also stipulate how much you’d like to withdraw each year.

Our calculator will confirm the amounts you can take and provide a graph to show how much of your fund will be used up over 20 years.

Managing drawdown can be difficult. You’ll need to think ahead and watch the markets. When markets are low, you need to sell more units to receive the same level of income, and you might find your invested pot goes down quicker than you imagined.

We can help you manage your drawdown effectively, so be sure to get in touch before making any decisions.

Things to consider if you have funds in Capped Drawdown

Capped Drawdown was available before 6 April 2015. It has been closed to new participants since then. Use our Capped Drawdown calculator to find out how much income you can take without exceeding the ‘cap’.

What is Capped Drawdown?

With Capped Drawdown, you take tax-free cash (up to the standard 25%) and the rest is invested to provide you with an income. That income is taxable and can rise and fall with the stock market. It is not guaranteed to pay for the rest of your life.

The amount you can take as income is capped. Your maximum income amount, calculated using Government Actuary Department (GAD) rates, is reviewed every three years until you reach age 75, after which it is reviewed annually.

If you exceed the cap, you are then considered to be using Flexi-Access Drawdown. Once this happens, you can’t go back into Capped Drawdown.

How can our pension calculator help?

Enter all the relevant details into our Capped Drawdown calculator and it will tell you the maximum amount you can receive each year, without exceeding the cap.

Capped Drawdown is complicated and once the cap is exceeded there’s no going back, so speak to us if you’re unsure about any withdrawals you plan to make.

Get in touch

Our Annuity and Drawdown calculators can help you plan for your retirement but speak to us before you make any decisions about your retirement choices, or before making withdrawals.

We can help to ensure that you have enough pension savings to achieve your desired lifestyle in retirement and also help to ensure your pension fund can last for the rest of your life.

If you have questions about your pension options or managing drawdown, please get in touch.

Email info@credencis.co.uk or call 01158 967 538.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Recent Comments