A recent study has revealed the unexpected environmental impact of Europe’s coronavirus lockdown.

Acknowledging the ‘widespread human suffering’ that Covid-19 has brought, the Centre for Research on Energy and Clean Air goes on to confirm the impact of improved air quality during April: 11,000 fewer deaths from pollution, 6,000 fewer children developing asthma, 1,900 avoided emergency room visits and 600 fewer preterm births.

The report concludes by calling on politicians to ‘prioritise clean air, clean energy, and clean transport.’

The campaigns of influential figures like David Attenborough and Greta Thunberg might have been out of the headlines in recent months but green issues remain. Ethical investing has been around for some time and investors have been taking note, as the continuing rise of Environmental, Social, and Governance (ESG) investment shows.

But what is ESG investing? What are the returns like? And how can we help you match your investment choices to your values?

What is ESG investing?

Traditional investment is typically interested only in returns, but sustainable and ethical investment takes ESG factors into account, alongside financial ones.

The three factors cover different areas of ethics and sustainability:

Environmental

Environmental factors could include a business’s carbon footprint.

Companies that understand and respond to investor concerns over climate change, renewable energy, and pollution, will appeal to ESG investors.

A track record of environmental negligence would have the opposite effect.

Social

Social factors will consider how a company interacts with the people and organisations it meets. This might be its staff or customers, or other companies.

Do they have a good standing within their community? Do they have a diverse staff with good working conditions and proportionate wages? Are they giving back to their local area?

Involvement in the manufacturing or selling of arms or tobacco would likely limit the amount of ESG investment a company received. As would involvement in gambling, or perceived exploitation in the supply chain.

Governance

Governance factors relate to a company’s internal practices.

To attract ESG investment a company must be seen to be acting ethically, whether through the democratic appointment of shareholders, transparent accounting, or legal business practices.

The rise of ESG investing

A recent report in the FTAdviser confirms that investment flows into ESG products increased by nearly 2,500% in the five years up to October 2019.

The Blue Planet-effect – named for the David Attenborough documentary series in which the scale of plastic pollution in the Earth’s oceans first entered the public consciousness – has been buoyed by the Greta Thunberg effect.

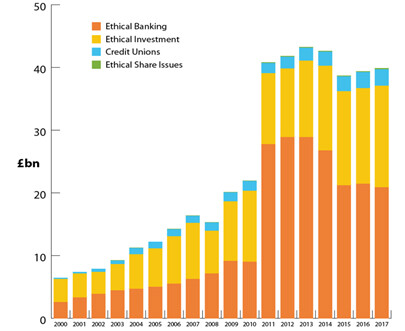

Triodos Bank, an ethical bank based in the Netherlands, has plotted the rise of ESG investing since the start of the millennium. The value of ethically held funds across banking and investment has increased significantly during that time and has nearly doubled since 2010.

Source: Triodos Bank

Investors are increasingly aware of ethical issues, especially where they impact the environment. Back in 2018, more than half of millennial investors were already investing sustainably, according to a separate FTAdviser report.

Environmental issues are clearly a huge factor in driving up the numbers of ethical investors, but other factors help account for the rise too. The lack of governance partly responsible for the 2008 global financial crisis or the gender pay gap identified at the BBC also highlight ESG issues.

As does Global Warming and the current pandemic. A recent Guardian report quoted the UN’s environment chief, Inger Andersen, as saying, “Nature is sending us a message”.

Leading scientists have called the outbreak a “clear warning shot”, adding that far more deadly diseases exist in wildlife but it was almost always human behaviour that caused diseases to spill over into humans.

Financial services firm Morningstar continues the story, showing the record-breaking rise of ESG investment during 2019.

How does it work?

Companies and fund managers can take several different approaches when investing based on ESG factors.

Here are five of the most common:

1. Negative screening – ruling out investments in companies known to have a poor record on ESG issues, or in industries harmful to people or the environment, such as tobacco, weapons, or palm oil.

2. Positive screening – proactively investing in companies with a proven track record on ESG issues and have had a positive impact on society or the environment.

3. ‘Best in class’ – opting to invest in a given sector, and choosing the company in that sector that demonstrates the highest level of commitment to ESG factors.

4. Sustainability investing – placing your money into funds that focus on environmental and sustainability goals, such as a move to renewable energy or reducing plastic waste.

5. Impact investing – investing to make a positive return but only choosing companies that have a positive impact on at least one environmental or social issue.

What about the returns?

The first ethical funds for UK retail investors appeared in the early 1980s, and since then client demand for responsible investment has increased tremendously. As demand has increased, the number of available funds has increased too.

If you opt to invest ethically, putting ESG factors at the forefront of your decision-making, you’ll have plenty of funds to choose from. Remember that we can help align your investment choices to your values on ethical and sustainable issues so get in touch.

The traditional view, that investors leading with ethical and social concerns, rather than financial ones, would inevitably see poorer returns, no longer holds.

Research by Morningstar found that ‘41 out of 56 of their ESG indexes have outperformed their non-ESG equivalents (73%) since inception’.

Elsewhere, This is Money report that ‘the FTSE4Good UK index beat the FTSE All-Share Index, returning 43% versus 42.5% over five years to 28 September 2018.’ The equivalent indexes in the US over the same period were even better, ‘the FTSE4Good US Index returned 155% compared to 129% for the S&P 500.’

Get in touch

Ethical investment has been on the rise since it first appeared in the 1980s. The generally upward trend of flows into ESG funds since then has led to the huge jump seen last year.

Meanwhile, issues of environmental and social responsibility fill news headlines daily. As millennials continue to embrace the climate change movement and issues of equality, the ESG market looks set to continue to grow.

If you have questions about ESG investing or would like to discuss your ethical investment options, please get in touch. Email info@credencis.co.uk or call 01158 967 538.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Recent Comments